Hello and welcome to the Alcohol Alert, brought to you by The Institute of Alcohol Studies.

In this edition:

IAS blogs

Lockdown study shows home drinking is a major contributor to alcohol-related violence 🎵 Podcast feature 🎵

Sunak U-turns on ending takeaway pints

Health experts hit back at Scottish Conservatives’ criticism of minimum unit pricing

Alcohol duty reform commences

Major Conditions Strategy interim report fails to tackle prevention agenda

Politicians must overcome ‘nanny state’ worries to improve Britain’s health

Alcohol Toolkit Study: update

We hope you enjoy our roundup of stories below: please feel free to share. Thank you.

IAS blogs

To read blogs click here.

Lockdown study shows home drinking is a major contributor to alcohol-related violence 🎵 Podcast feature 🎵

The proportion of violent incidents in England relating to alcohol did not fall as much as expected when pubs, bars, and restaurants were closed during the COVID-19 pandemic restrictions.

A new study by IAS and the University of Liverpool has found that there was only a 2.7 percentage point reduction in the proportion of violence that was alcohol-related while on-trade alcohol outlets were closed due to COVID-19 restrictions. Violent incidents cover a range of offences, such as murder, grievous bodily harm, and stalking and harassment, and the drop in these was far less than expected. Further to this, there was also no fall identified in the proportion of domestic violence which was alcohol-related when the on-trade was closed.

Study author Dr Carly Lightowlers said:

“While alcohol-related violence fell when many bars and pubs closed during lockdown, alcohol sold in off-trade sites like supermarkets and off-licences remained a crucial driver of violent incidents – including domestic violence – as the proportion of violence which was alcohol-related remained close to pre-pandemic levels.”

When the on-trade was forced to close during lockdowns and other COVID-19 restrictions, it gave the chance to isolate the impact of off-trade alcohol on violence. The researchers used police-recorded data to look at how monthly alcohol-related violence figures changed – specifically the proportion of violence overall which was alcohol-related – when on-trade outlets were open, compared to periods when they were closed.

“These findings suggest that off-trade alcohol availability needs to be taken far more seriously when developing and implementing policies to reduce alcohol-related violence”, said co-author Lucy Bryant.

Violence reduction interventions often focus far more on violence in the night-time economy (e.g., policing operations), in part because this kind of violence is more visible to the police, public, and policymakers. However, this overlooks a great deal of alcohol-related violence that occurs in other sites, including the home. It also overlooks certain effective violence reduction measures policymakers might engage in which reduce alcohol availability – for example, through the licensing of off-trade sites. Currently, local residents and responsible authorities cannot object to new off-trade sites being licensed in their neighbourhoods based on concerns that there are already many outlets nearby. Reform of the licensing system to this effect would likely reduce violence rates.

In their call to policymakers, the researchers argue for a distinct focus on off-licensed premises and their contribution to violence – particularly domestic violence. Report author, Lucy Bryant, said:

“There is an unequal burden of alcohol-related violence experienced by people from more deprived backgrounds, and we know that alcohol outlets cluster in more deprived neighbourhoods. More effective policies to reduce off-trade availability would tackle this type of violence, and therefore also increase health equality.”

Sunak U-turns on ending takeaway pints

After running a consultation, the government announced that a licensing rule brought in during the pandemic would end. However, after intervention from the Prime Minister, the rule will now continue.

During the pandemic, licensing restrictions were relaxed so that on-trade outlets – such as pubs and bars – could serve takeaway alcohol without having to apply for a specific licence. The measure aimed to support the on-trade during a challenging period for the hospitality sector.

The Home Office held a consultation earlier this year on whether the measure should be kept, go back to pre-pandemic rules, or a middle way.

Despite indicating that they didn’t plan on reverting to pre-pandemic rules, following the consultation the Home Office announced that it would do so, due to the majority of respondents (65%) favouring a return to those rules.

In IAS’s response to the consultation, we supported a return to pre-pandemic rules, as:

“This will allow the Responsible Authorities and other Parties the opportunity to make Representations regarding the suitability of the permissions that are sought and to risk assess them in relation to the statutory Licensing Objectives.”

We also highlighted that the pandemic rules would increase the availability of alcohol, which is linked to increases in alcohol harm.

However, on 15 August it was announced that the easement would in fact be extended until 31 March 2025, “to continue to provide vital support to the hospitality sector.”

The British Beer and Pub Association and UKHospitality had lobbied the government to overturn their decision, with the BBPA stating that:

"We need government to support our pubs and allow them to diversify and innovate, not hold them back with more red tape and unnecessary regulation.”

After the U-turn, a number of industry figures welcomed the move, with the chief executive of the Night Time Industries Association stating it was “common-sense prevailing” and the decision will “maintain continuity in trading for businesses that have relied on off-sales for the past three years.”

UKHospitality’s Kate Nicholls said:

“This is a very welcome intervention by the Prime Minister in response to representations from UKHospitality and the sector more widely…As the Prime Minister says, this is not the time to tie businesses up in additional bureaucracy and cost just as they continue their recovery from the pandemic.”

This does produce a slight tax loophole regarding the draught duty relief introduced as part of the alcohol duty reform. As the duty on draught alcohol in the on-trade is now lower than off-trade alcohol in supermarkets, people would be paying less duty by purchasing their off-trade/takeaway alcohol from pubs and bars. However, this doesn’t make any financial sense for people trying to reduce the amount they are paying for alcohol, since on-trade alcohol is almost always much more expensive than the off-trade overall.

Health experts hit back at Scottish Conservatives’ criticism of minimum unit pricing

A group of leading health experts wrote an open letter, published in The Lancet on 11 August, expressing their concerns about a complaint made by a member of the Scottish Parliament regarding the evaluation of minimum unit pricing (MUP) for alcohol in Scotland.

The group stated that, whether intentionally or not, the complaint made by Dr Sandesh Gulhane MSP, Scottish Conservative Shadow Cabinet Secretary for Health and Social Care, “gives the impression of seeking to undermine the policy”.

The signatories, which included representatives from the British Medical Association, London School of Hygiene and Tropical Medicine, European Alcohol Policy Alliance, House of Lords, and academics, defended Public Health Scotland’s evaluation methods as “entirely appropriate” and “comprehensive”.

The letter concluded by outlining that MUP has worked to lessen health inequalities in Scotland, one of the policy’s main aims, and ends with a clear message to policy makers, that they:

“can be confident that there are several hundred low-income people in Scotland, who would have died from alcohol, who are alive today as a result of minimum unit pricing.”

Alcohol duty reform commences

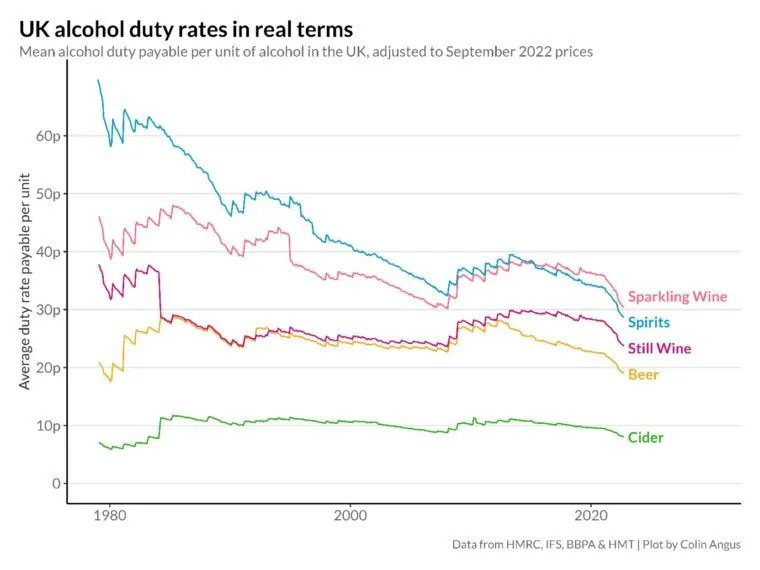

The alcohol duty reform, which sees alcohol taxed based on the strength of products, commenced from the 1st of this month.

The media primarily focused on how the duty of specific drinks will change, while also covering some industry criticism of the plans. The BBC said that tax will increase on wine and spirits, but fall “on fizz”.

Stuart Adam, senior economist at the Institute for Fiscal Studies, pointed out that:

"It's not a tax increase overall, it's increased some types of alcohol and reduced others which I think is a sensible reform. It's now going to reflect more closely the alcohol content of different drinks, as it should.”

Over the past few decades, alcohol duty rates have seen a significant drop in value in real terms:

The chancellor, Jeremy Hunt, said:

"The changes we're making to the way we tax alcohol catapults us into the 21st century, reflecting the popularity of low-alcohol drinks and boosting growth in the sector by supporting small producers financially.”

Elinor Jayne of Scottish Health Action on Alcohol Problems (SHAAP) spoke to BBC 5 Live and said the rise didn’t go far enough as consecutive freezes have made alcohol far more affordable and contributed to increased deaths.

She also said that the government has the choice to promote the alcohol industry or support public health, and raised the issue of the overall cost of alcohol harm and how duty doesn’t nearly cover this.

William Robinson, managing director of Robinson Brewery, which operates 250 pubs, welcomed the difference in draft beer duty between pubs and supermarkets, but said rising tax on other alcoholic drinks could be passed on to customers.

The Wine and Spirit Trade association – which has been vociferous in its objections to the duty reform – said it was the biggest tax rise on wine for nearly 50 years and imposes “more inflationary misery on consumers”.

"Ultimately, the government's new duty regime discriminates against premium spirits and wine more than other products," WSTA chief executive Miles Beale said.

One Northern Irish businessman said it was “sickening” and that "it's becoming increasingly difficult to mitigate and keep costs down - everything is going up - there's only so much we can ask of our customers.”

Tim Martin, Wetherspoon’s boss, said it was bad news for hospitality and will cost his company an extra £8 million a year:

“The compounding factor is that pubs pay 20% VAT in respect of food sales, whereas supermarkets pay nothing. Pubs also pay about 25p per pint in business rates, whereas supermarkets pay a fraction of this amount - perhaps two pence a pint or so. Supermarkets use this tax advantage to subsidise beer and wine prices. The combo of tax inequality and tax increases is bad news.”

Diageo branded the duty changes a stealth tax that will increase prices for consumers. Debra Crew, the new chief exec of Diageo, said that the increase in duty for spirits is a hammer blow for pubs and consumers.

However, in a letter in response, addiction specialist Dr Rachel Turner wrote:

“Diageo is overstating the impact of the rise in alcohol duty. If the total tax on a one-litre bottle of spirits goes up by 1.16p, that equates to 2.9p per unit of alcohol. Moderate drinkers will not be overly affected by this. The combined UK chief medical officers’ guidance is to drink no more than 14 units a week. If all these were taken in gin, that would cost an extra 41p per week. Even those drinking twice that would still be only spending an extra 82p a week or £3.28 a month. Hardly “a hammer blow” to drinkers, and as for the industry something tells me that it will continue to make vast profits and satisfy shareholders.”

For more information on the duty reform and how it could affect public health, read our Spring Budget Analysis.

Major Conditions Strategy interim report fails to tackle prevention agenda

The Department of Health and Social Care (DHSC) published an interim report on its Major Conditions Strategy on 21 August. The strategy aims to set out how health and care delivery will evolve to improve outcomes and better meet the needs of our population. It focuses on six groups of conditions: cancers, cardiovascular disease (including stroke and diabetes), musculoskeletal disorders, mental ill health, dementia, and chronic respiratory disease. The strategic framework is as follows:

The report identifies alcohol as a major risk factor for many of these major conditions, and the wider determinants of health, stating: “our physical environments can have enormous impacts on our health and our behaviours.” It also identifies the importance of prevention.

Yet, despite stating this, many have pointed out that the policies mentioned in the report are not new and do not focus on prevention. Katherine Merrifield of the Health Foundation wrote:

“There is only one new policy announcement in the prevention space: government consulting on adding pack inserts to tobacco products to encourage smokers to quit. This new policy is not enough to address the impact of risk factors such as smoking, alcohol and obesity on people’s health.

“The report is anchored in the role of clinical services and places too much focus on individual behaviour change and personalised prevention. This ignores broader evidence on the state’s crucial role in taking population-level action on risk factors and the wider determinants.”

Dr Adam Briggs, also of the Health Foundation and a public health registrar, explained his concerns in a Twitter thread, including that:

“It’s a handy bookmark of existing gov health & public health policy commitments with a promise that the final report will prioritise change in 5 areas… But aside from describing a general approach, we don’t know what will actually be done to deliver these priorities.”

Ailar Hashemzadeh of Alcohol Change UK wrote that it is “disappointing” that there is no mention of “proper regulation of alcohol labelling and marketing, setting a minimum price for a unit of alcohol in England to reduce the availability of very strong, cheap alcohol and making improvements to the alcohol duty system”.

Association of Directors of Public Health president Jim McManus said:

“Preventative action remains better than cure for people’s health, the NHS, and the economy. While public health and the work of local authorities is mentioned throughout the report, directors of public health, who are responsible for the health of their population and provide leadership for its improvement and protection, have disappointingly not been acknowledged.”

Politicians must overcome ‘nanny state’ worries to improve Britain’s health

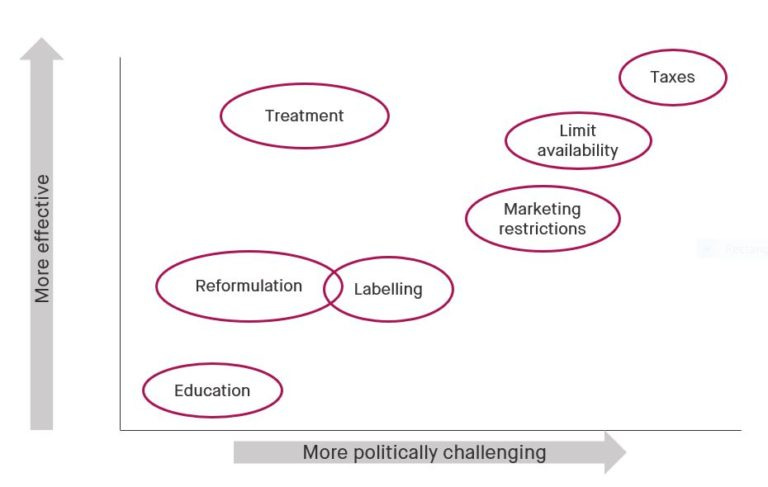

New research from the Social Market Foundation suggests that policies like higher taxes on cigarettes, alcohol and junk food, stricter licensing regulations to limit places to buy such products, and regulations on marketing like banning ads before a 9pm TV watershed, could all help save lives.

By contrast, ‘softer’ approaches like educational and information campaigns are likely to have less of an impact.

The SMF paper gathers evidence on a range of policies that can help reduce harm from smoking, drinking, obesity and gambling and compares them on effectiveness.

Dr Aveek Bhattacharya, SMF Research Director and author of the report, said:

“People are increasingly waking up to the scale of the public health challenge facing the country, which means far too many people suffer needlessly and die too soon.

“There is a natural tendency towards wishful thinking, and hoping that this can all be solved the ‘easy way’, through education and information. But if politicians remain unwilling to tax and regulate harmful commodities, they leave the most powerful tools at their disposal in the box. Such measures are more politically contentious, but they are necessary and life saving.”

Alcohol Toolkit Study: update

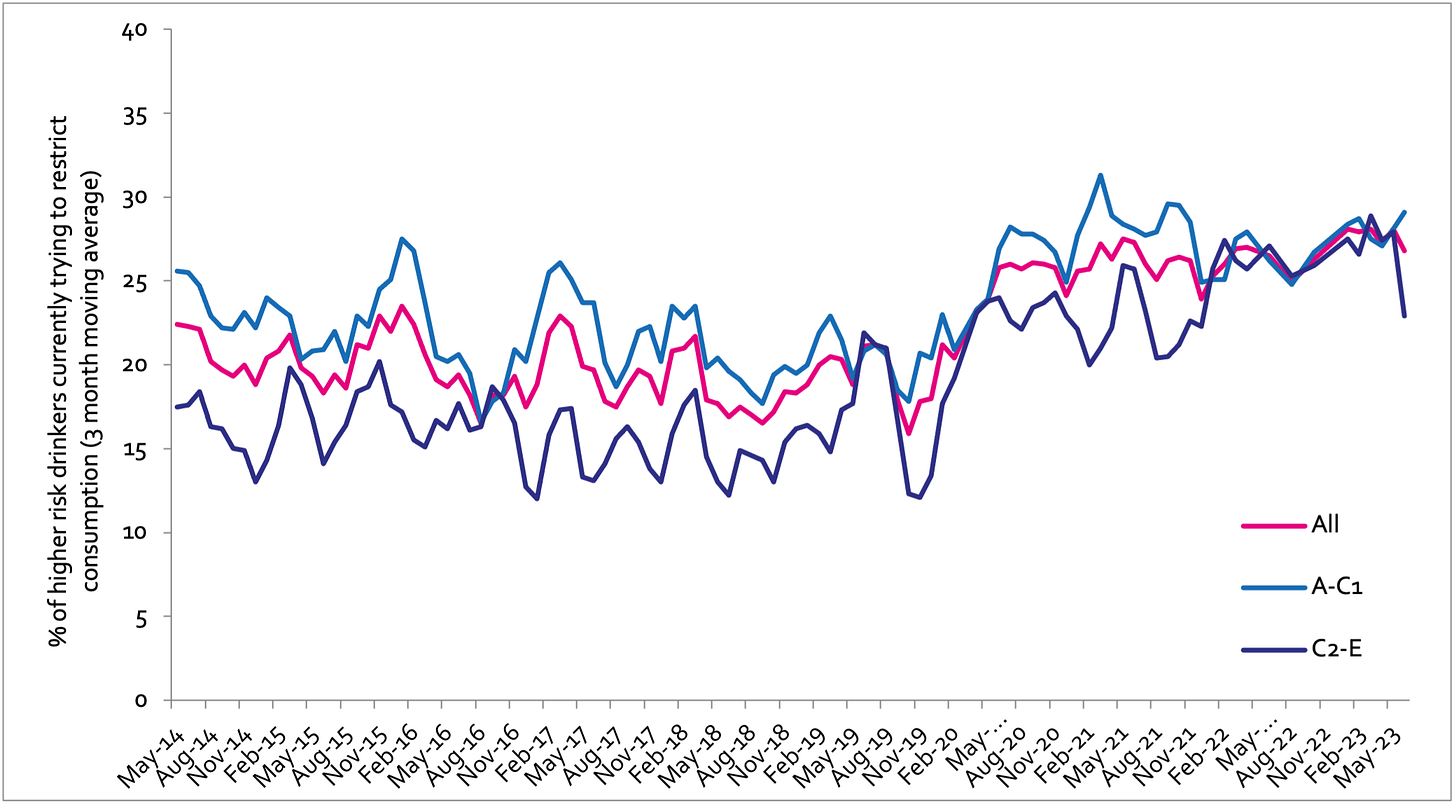

The monthly data collected is from English households and began in March 2014. Each month involves a new representative sample of approximately 1,700 adults aged 16 and over.

See more data on the project website here.

Prevalence of increasing and higher risk drinking (AUDIT-C)

Increasing and higher risk drinking defined as those scoring >4 AUDIT-C. A-C1: Professional to clerical occupation C2-E: Manual occupation

Currently trying to restrict consumption

A-C1: Professional to clerical occupation C2-E: Manual occupation; Question: Are you currently trying to restrict your alcohol consumption e.g. by drinking less, choosing lower strength alcohol or using smaller glasses? Are you currently trying to restrict your alcohol consumption e.g. by drinking less, choosing lower strength alcohol or using smaller glasses?

Serious past-year attempts to cut down or stop

Question 1: How many attempts to restrict your alcohol consumption have you made in the last 12 months (e.g. by drinking less, choosing lower strength alcohol or using smaller glasses)? Please include all attempts you have made in the last 12 months, whether or not they were successful, AND any attempt that you are currently making. Q2: During your most recent attempt to restrict your alcohol consumption, was it a serious attempt to cut down on your drinking permanently? A-C1: Professional to clerical occupation C2-E: Manual occupation

The UK Alcohol Alert (incorporating Alliance News) is designed and produced by The Institute of Alcohol Studies. Please click the image below to visit our website and find out more about us and what we do, or the ‘Contact us’ button. Thank you.